FAQ

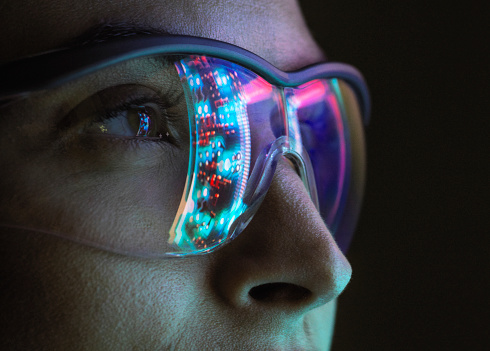

At Empress Capital we back early stage Australian and New Zealand Artificial Intelligence Companies. Our primary focus is on Pre-Seed and Seed stage investments with the view of supporting those companies to flourish not just at this stage. We will also invest in small number later stage companies where we believe there is opportunity.

We look for passionate founders who have a growth mindset and understand why they are building their products. We look for founders and teams to be honest , values driven and understand what they don’t know.

Our primary focus is on Pre-Seed and Seed stage and we do invest in companies pre revenue with sound business models. We plan to support our superstar companies across multiple rounds. We will also invest in small number later stage companies where we believe there is opportunity.

Investment Process for our Portfolio Companies

- Application

Application via website / direct referral to venture partner send Empress pitch deck. - Initial meeting

An initial phone / video call with one of the investment team. - Team discussion

We will discuss the opportunity in our weekly meeting and decide if we would like to continue. - Pitch

Meeting with investment team to pitch idea. - Investment Committee Decision

Internal discussion with the investment committee deeper dive on team, go to market, product, defensibility. An investment case is pulled together for and decision made to proceed or note. If not we give constructive feedback. - Term sheet

Documents signed - Welcome to Empress

Onboard

As we invest in early stages of company growth we are always interested in talking to founders early in their journey. We believe in partnering long term so even if now is not the right time we always want to help. Why not get in touch with us.

The Empress Capital Australian and New Zealand Artificial Intelligence Fund is open to suitable sophisticated investors or wholesale investors only.